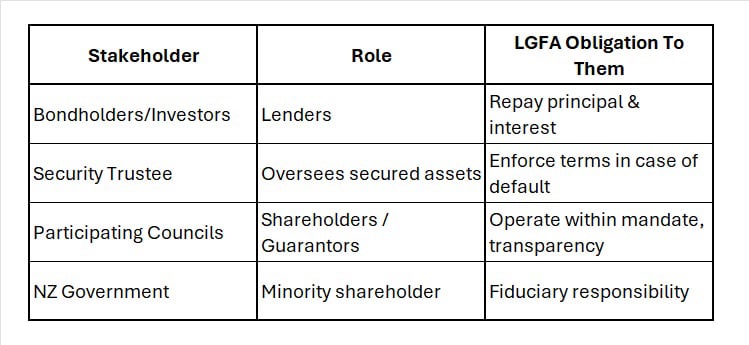

🔹 Summary Table

What is the LGFA?

LGFA is a Fund that was setup using a limited liability company in 2011. The excuse was to provide New Zealand councils with supposedly cheaper long-term debt — But what lurks beneath its surface?

CROW asks: “Is this the crocodile in the swamp… waiting to strike ALL ratepayers properties?”

• 20% owned by the New Zealand Government.

• 80% owned by participating councils, including Whangarei District Council and many others.

• Its sole customers are those same councils.

The obligees of the New Zealand Local Government Funding Agency (LGFA) are its creditors—the entities to whom it owes money or obligations. These include:

________________________________________

These are the institutions and individuals who lend money to the LGFA by purchasing its bonds or short-term bills. As of recent disclosures, they include:

• Domestic banks (e.g., ANZ, BNZ, Westpac, etc.)

• Domestic institutional investors (e.g., KiwiSaver funds, ACC, superannuation schemes)

• Offshore investors (large global funds seeking high-grade returns) & can assume anonymity

• The Reserve Bank of New Zealand (also holds some LGFA securities)

These investors expect timely interest payments and the return of principal — making them the primary financial obligees of LGFA.

________________________________________

LGFA debt is secured. A Security Trustee holds legal title over pledged assets (i.e., council rates revenue and other securities) on behalf of investors. LGFA is obligated to meet loan terms enforced by this trustee.

In other word’s your rate payments will meet their obligation and your property is security

________________________________________

Ironically, councils are both owners and guarantors of LGFA, yet LGFA owes them certain duties (e.g., to operate within mandate, to manage credit risk).

Councils are also obligated to cover LGFA debt if another council defaults, due to the Joint and Several Guarantee.

________________________________________

In Whangarei, the most dangerous people in council may not be the elected councillors you vote for, (who may not always be aware of the full picture). It's the unelected power brokers who pull the financial strings: the CEO, the Finance Director, and other activist staff within the council. These are the architects and staunch defenders of the LGFA—a scheme that allows councils to borrow endlessly, secured against your property through rates. Shockingly, they have recently refused to even discuss the LGFA publicly with residents, shutting down vital dialogue at a time when transparency is desperately needed. Their silence isn’t just dismissive—it’s dangerous. When unelected officials shield themselves from scrutiny while driving policies that plunge councils deeper into debt, ratepayers lose control of both their democracy and their financial future.

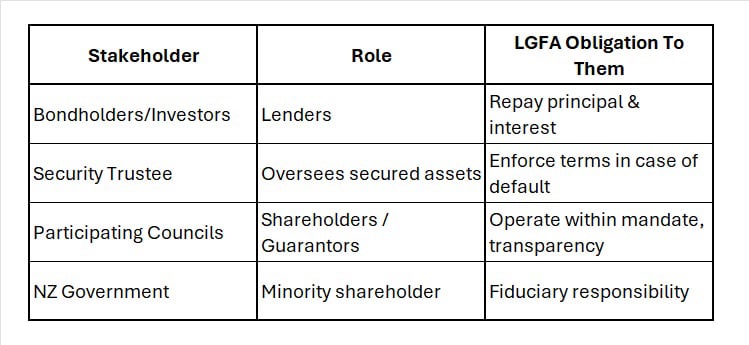

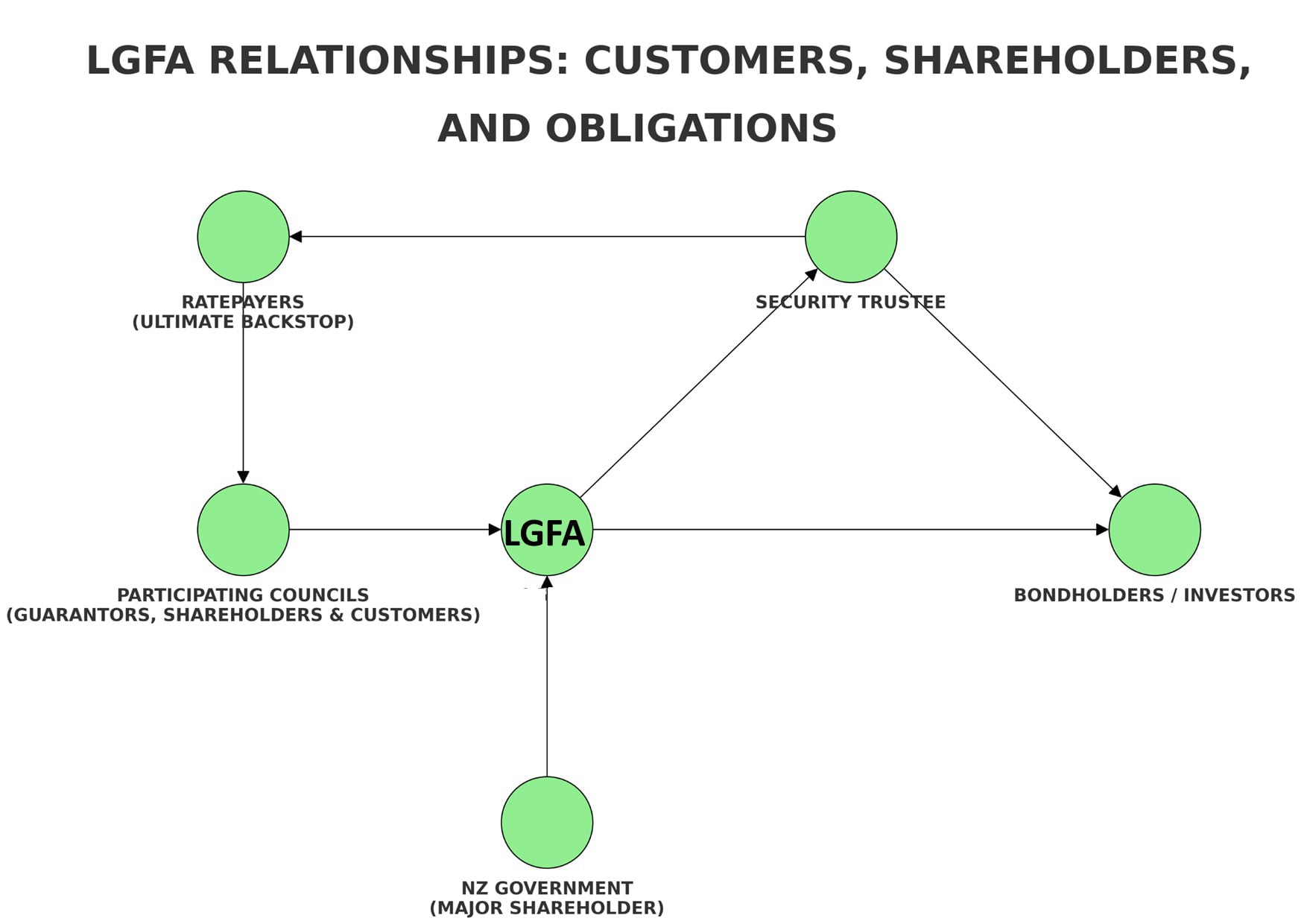

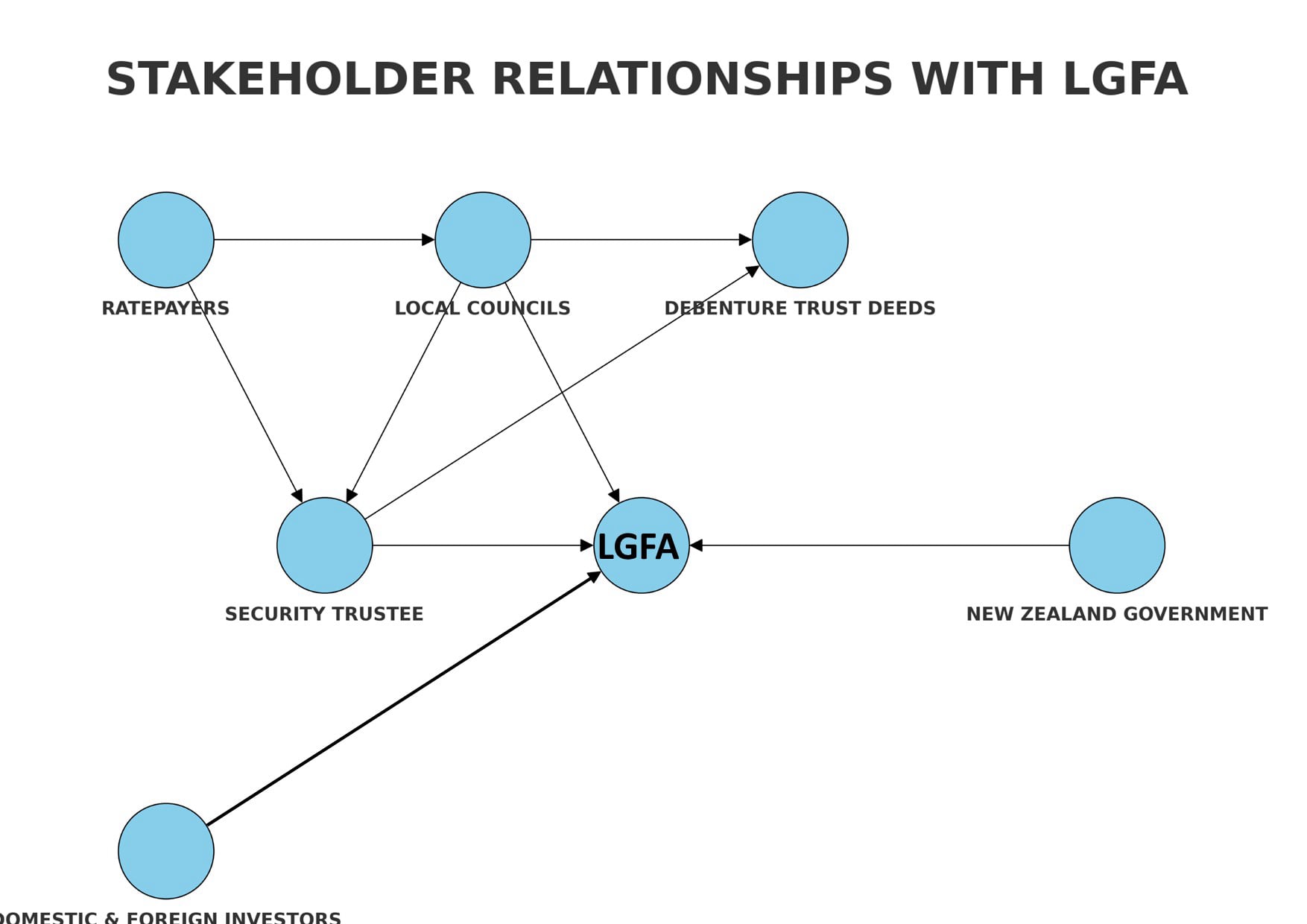

Here is a diagram illustrating the relationships between LGFA, its customers, shareholders, and ultimate obligees:

• LGFA is:

o Funded by ‘for HIGH profit Offshore’ investors,

o Owned jointly by Participating Councils and the New Zealand Government,

o Managed under the oversight of a Security Trustee protecting investors’ interests.

o Shareholders of LGFA,

o Borrowers are the CUSTOMERS of the LGFA,(Councils)

o Guarantors of LGFA debt (joint & several liability). via RATE PAYERS Assets

fund councils and ultimately bear ALL the financial risk.

From its Statement of Intent:

• Primary objective: Provide long-term, cost-effective financing to councils.

• Secondary objectives: Financial resilience, sustainable borrowing, and access to capital markets. *Note Sustainable & Resilient are UN/WEF - WOKE terms for climate change Spending

• Strategic emphasis: Resilience, climate infrastructure, and sustainability.

But in practice, it enables massive borrowing for politically aligned projects like:

• "Resilience upgrades"

• Climate-driven infrastructure

• Co-governance-enabling projects

• Housing intensification and smart city tech

1. Councils apply to LGFA for loans.

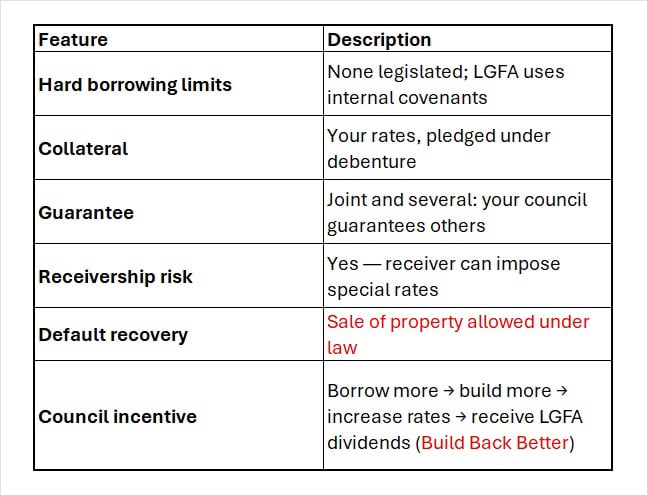

2. Loans are secured against rates revenue — councils must sign a Debenture Trust Deed.

3. Councils are also guarantors, meaning:

o Joint and several liability: If one council defaults, others must pay.

o Ratepayers across New Zealand are now financially tied together, whether they voted for it or not.

Unlimited borrowing As long as councils can raise rates, they can borrow more. LGFA encourages this.

DOES WDC FINANCE DIRECTOR KNOW THIS?

Rates = Collateral

Your rates are pledged as security against the councils debt and for other council’s debts – Your property is legally bound as security against your rates — even for other councils' debt.

Council defaults → Rate rises

If one council fails, others may be forced to raise rates to cover.

Receivership powers

Under Section 115(2) of the Local Government Act, a receiver can be appointed who sets special rates to recover debt — bypassing elected representatives.

No public say

Ratepayers were never asked if they wanted to guarantee a $17 Billion + + debt facility. There is no requirement in LGFA legislation for ratepayer consent, and councils did not explain to residents that they have guaranteed the LGFA’s total debt across all councils.

Shareholder conflict

Councils profit from dividends via LGFA shares — while also increasing rates to service LGFA debt.

While promoted as a cooperative lending body, LGFA is increasingly aligned with:

• UN Sustainable Development Goals (SDGs)

• Climate finance infrastructure

• Centralised globalist frameworks through LGNZ and central government partnerships

This aligns council funding with global climate agendas, often sidestepping public consent.

• LGFA allows councils to borrow endlessly, backed by your rates, with little public scrutiny.

• You are financially liable not just for your own council’s spending, but for any defaulting council in NZ.

• If enough councils default, your property may be subject to forced rates increases or even sale.

• YOU WILL OWN NOTHING AND BE UN-HAPPY WEF 2016?

• LGFA is designed to operate like a fund — serving its investors and shareholders (including government and councils), not the public.

• Its strategy is shaped by climate resilience, not local affordability or democracy.

1. Why were ratepayers never consulted on joining a national joint-liability debt fund?

2. Who approved our council’s shareholding in LGFA — and are they profiting?

3. How much debt has our council committed to, through the LGFA?

4. What are the “extraordinary circumstances” where we could be forced to cover other councils’ debts?

5. Why does LGFA promote centralised control and resilience spending over community consent?

6. What are the financial rewards for the fund managers and all stakeholders in the business model.

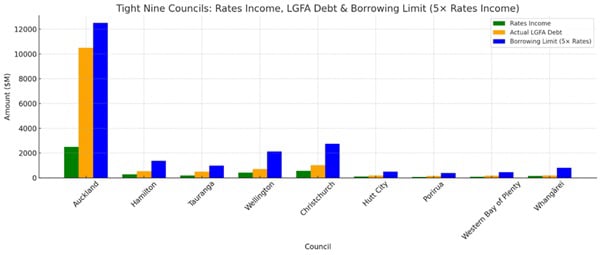

The "Tight Nine" are the nine foundation shareholder councils that partnered with the New Zealand Government to establish LGFA. These founding councils were the Trojan Horse — chosen for their planned extreme growth, they quietly opened the gates to unchecked borrowing and centralised financial control. These councils collectively provided the initial capital and governance to create a centralised borrowing vehicle for local authorities.

✅ The original Tight Nine councils:

1. Auckland Council

2. Bay of Plenty Regional Council

3. Greater Wellington Regional Council

4. Hamilton City Council

5. Tauranga City Council

6. Wellington City Council

7. Western Bay of Plenty District Council

8. Whangarei District Council

9. Hastings District Council

Who decided Whangarei should invest in creating this Trojan Horse and become a founding shareholder?

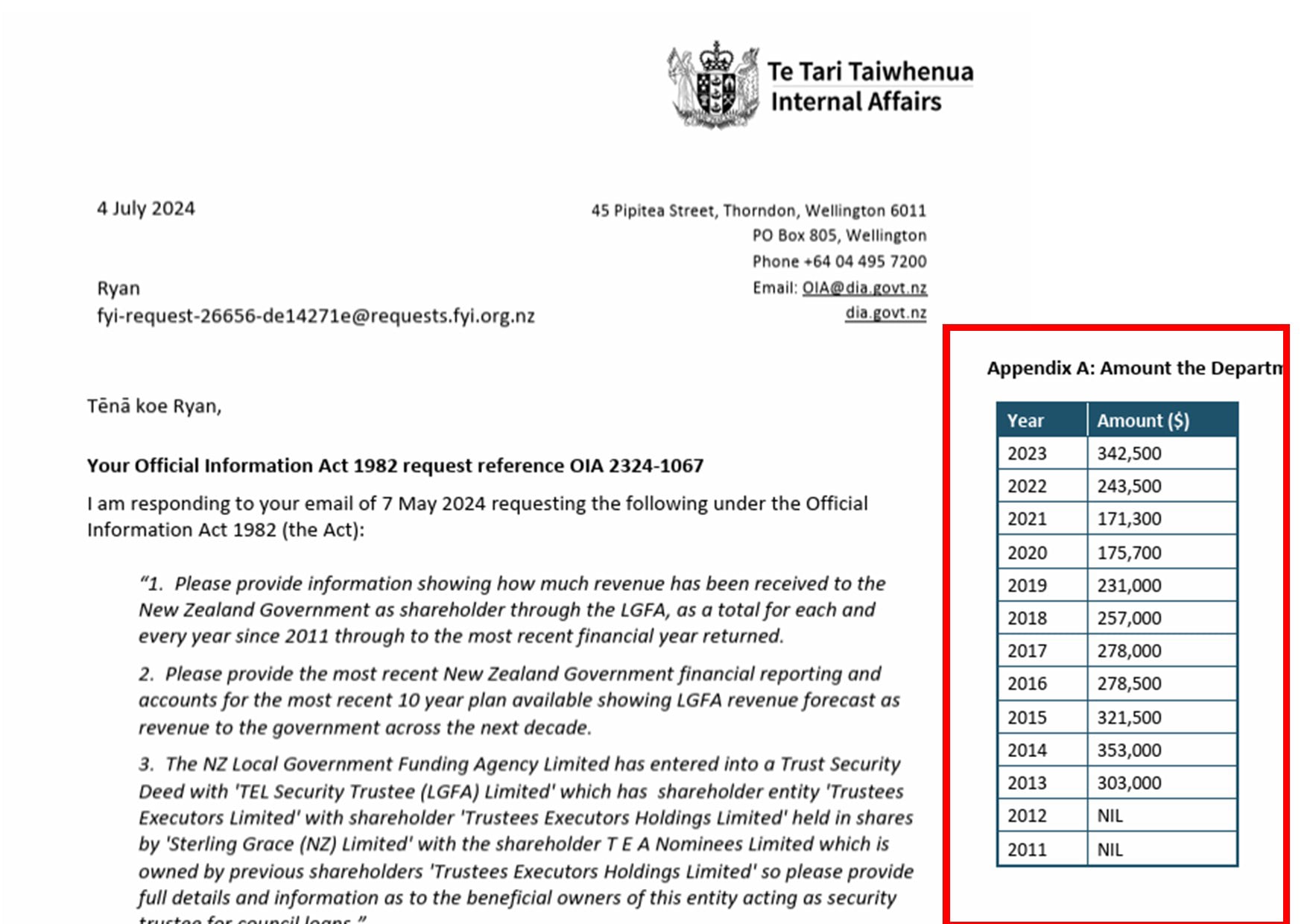

How Much Dividend is the Government Getting From The LGFA = ANSWER

Assuming The Government Owned 20% We Can ASSUME Total Dividend For 2023 was 500% of $342,500 Which Means That $1,712,500 was distributed as a dividend to the Government & Other Stakeholders.

Remember this is after the For Profit Fund has made its profits and the International Institutional Investors have made their profits?

• The decision was made by Whangarei District Council (WDC), typically through a council vote—likely led by senior management and the mayor at the time, around 2011–2012, when LGFA was first established.

• Public records and council minutes from that period would show who voted and whether there was robust scrutiny.

• Unlikely. There is no known record of public consultation or referendum on becoming a founding LGFA shareholder — despite the enormous financial and democratic implications.

• Instead, this decision was likely bundled within broader financial strategy documents or Annual Plan processes with little to no transparency about the long-term consequences (like shared liability or unlimited borrowing limits).

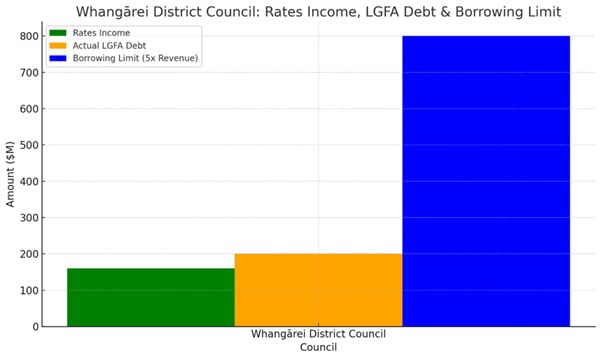

By joining LGFA, WDC gained access to massive borrowing capacity — up to 5x its annual revenue — far beyond what traditional prudence would suggest.

2. Ratepayer Liability:

Residents are now jointly and severally liable not only for WDC’s debt, but potentially for the debts of all other councils in the LGFA network if they default.

To meet debt obligations and satisfy LGFA’s financial criteria, councils are incentivised to increase rates and asset sales, often without adequate public oversight.

Participation in LGFA can drive local councils to align with centralised financial and climate-related priorities, undermining local decision-making and flexibility in planning.

✅ What Limits LGFA’s Lending Ability?

There are very few hard limits. The LGFA operates with a high degree of autonomy, but several factors technically "constrain" its lending:

1. Council Credit Quality & Self-Imposed Covenants

1. Council Creditworthiness & LGFA Lending Rules

To qualify for LGFA loans, councils must meet strict financial thresholds, including:

• Net Debt-to-Revenue Limit:

Councils can borrow up to 5 times their annual revenue (i.e. 500% debt-to-revenue ratio).

• Interest-to-Rates Ratio:

The cost of interest payments must stay within a set percentage of total rates collected (to ensure councils can afford repayments).

• Liquidity Requirements:

Councils must show they can cover short-term obligations, with liquidity ratios also aligned with the 500% borrowing cap.

• These are not regulatory caps — they’re LGFA’s internal thresholds, often flexible.

• Each borrowing council enters a Debenture Trust Deed.

• This is a security agreement pledging rates revenue as collateral.

• But again, there is no statutory limit on how much a council can borrow — as long as it can keep raising rates, it remains “creditworthy.”

3. LGFA Board Risk Appetite

• The LGFA Board determines how much exposure it is comfortable with — but its incentive is to grow.

• Its stated objectives include expanding lending and "deepening the investor base," not limiting exposure.

1. Your Rates – Present and Future

• The primary asset securing the loans is the council's legal power to levy rates.

• If a council fails to meet obligations, the LGFA or a court-appointed receiver can:

o Impose special rates

o Force collection

o Ultimately sell YOUR property to recover debt (as allowed under s115(2) of the Local Government Act 2002)

2. Joint and Several Guarantee

• Most councils must sign a guarantee for all LGFA debt.

• This means any council's rates base can be INCREASED to cover a default elsewhere.

• Your council is exposed to other councils’ failures.

3. General Rates Revenue Pledge

• Councils assign their entire rates stream — not just a portion — under the security documents.

• This makes LGFA a senior secured creditor, ahead of most other obligations.

• In worst-case scenarios, a council's physical and financial assets could be sold — but this is rare and politically explosive.

• The reality is: property owners (ratepayers) are the "backstop."

If a council can continue increasing rates, it can continue borrowing more. Since councils are incentivized to fund long-term “resilience” or “climate adaptation” projects with borrowed money — and because they profit from LGFA dividends — they have no strong reason to stop.

'Build Back Better': Who said the catchphrase first?

This visual clearly highlights how current debt already exceeds annual income and how much more the council could theoretically borrow under LGFA rules. Let me know if you'd like to break this down by debt per ratepayer or visualise other councils similarly

This shows how far each council has extended its debt relative to its rates base — and how much more they could legally borrow under LGFA rules.

Your Rates Are the Collateral — and If Council Defaults, You’re the One Who Pays.

Free AI Website Builder

We're social!

WhatsApp

WhatsApp

Telegram

Telegram

Facebook

Facebook

YouTube

YouTube